The Nature of FOREX Market Trends

In the FOREX market, as well as in any other market, the

prices at which you buy or sell a currency with another, slightly changes on

every transaction, a buy will increase this price and a sell will decrease it.

There’s a reason for every transaction; there’s a cause every time buys/sells

supersede sells/buys. If a super-duper computer could be fed with all this

information at the time every transaction happens, then it could predict the

market. But no one has this information and such a computer does not exist

either.

The same problems are common in the human quest for

understanding nature and so, a set of concepts and tools have been developed to

deal with them. This branch of knowledge goes today under the name of statistics.

It treats complex processes in terms of averages and probabilities and this, in

most cases, is all you need to know. An airplane going through the air hits and

gets hit by an enormous number of air molecules, all you need to know is that in

the average, the hits under the wing are likely to be more and stronger than the

hitting on its upper side. Such is the

likelihood, that a flight in any airplane feels perfectly steady. That is the

case of real size airplanes and even model size ones, but what if we kept

reducing the airplane size?

The Brownian motion

Brownian

motion (named in honor of the botanist

Robert Brown) originally referred to the random motion observed under

microscope of pollen immersed in water. This was puzzling because pollen

particles suspended in perfectly still water had no apparent reason to move all.

Einstein pointed out that this motion was caused by the random bombardment of (heat

excited) water molecules on the pollen. It was just the result of the molecular

nature of matter.

Brownian

motion (named in honor of the botanist

Robert Brown) originally referred to the random motion observed under

microscope of pollen immersed in water. This was puzzling because pollen

particles suspended in perfectly still water had no apparent reason to move all.

Einstein pointed out that this motion was caused by the random bombardment of (heat

excited) water molecules on the pollen. It was just the result of the molecular

nature of matter.

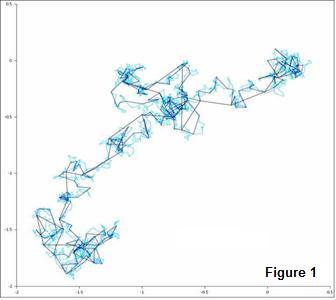

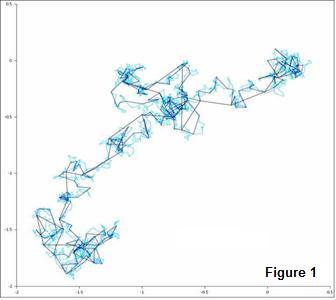

Modern theory calls it a stochastic process and it has

been proven that it can be reduced to the motion a “random walker”. A one

dimensional (1-D) random walker is one that is as likely to take a step forward

as backward, say on the X axis, at any given time. A 2-D random walker does the

same in X or Y (see illustration).

The stock prices change slightly on every transaction, a

buy will increase its price a sell will decrease it. Subject to thousands

of buy

and sell transactions stock prices should show a one-dimensional Brownian

movement. This was the subject of

Louis Bachelier PhD thesis back in 1900, "The theory of speculation.". It

presented a stochastic analysis of the stock and option markets. Currency rates

should behave very much as a pollen particle in water too.

Drift and Trend

Let’s assume now that the pollen particles are floating,

not in still water, but drifting in a flow. Its motion will then be the combined

effect of the drift plus the random one. The drift is the predictable part; the

random, the one that is not. The existence of drift is known or inferred from

macro information affecting all the system, say inclination, wind, some sort of

propeller, etc. The random component can only be treated in terms of averages

and probability.

Back in the FOREX market, drift motion of rates are called

market trends. Some underlying cause is making, say the buys, more likely than

the sells. For instance, consider a

hypothetical case in which a new tax on the manufactures passes US Senate and

the House; speculators figure that this will affect the buying power of the US

dollar and will start selling USD to other currencies, altering their rates

correspondingly. With micro-steps up and down caused by a myriad of shorter term

causes, the GBP/USD will show a longer term up-trend, the USD/JPY a longer term

down trend and so on.

The knowledge of the existence of such a trend does not

mean that an investor selling dollars will automatically make a profit; it just

makes it more likely. A gambling example of a trend is that of counting cards in

a Black Jack game. As the deck of cards thins away, the card counter knows how

many high cards are left in it, so he can estimate his chances of pulling one or

the bank beating him on what he already has. The counter, can't tell what the

next card will be, he just knows the odds or, in other words, he knows the

trend. Yet, that simple knowledge is enough to break the bank.

There is another important estimate, besides the strength

of a trend that an investor has to make. He must figure for how long that trend

is likely to hold. For example, an unemployment report showing a 0.1 point

decrease can hardly overshadow for long the effect of the new tax bill. Any

trend produced by the first event has a foreseeable shorter scope than the

second. So trends have a life span, investments based on trend information must

be strong enough that it can payback within this time span.

Actually what is trend and what is random depends on the

time scale being considered. For events generating trends in the days range,

smaller events causing hourly rates changes are considered random and changes

introduced by any slower longer range trend may be neglected; whereas events

generating trends in the hour range, must consider minutely changes as random

and weekly ones as slow trends to be neglected within that range.

Every rate change is caused by some

event, small events happen all the time, the more transcendental the event; the

fewer they are.

Estimating the Strength of a Trend

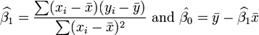

The tool for estimating the strength of a trend is the

linear regression. This is a mathematical method that finds the best fitting

line to a data series. This best fitting line is the one in which the sum of the

squared deviations to the data, called residuals, is minimum. The equation of a

line in the xy plane is:

y

= b1

x

+ b0

If the data pairs are (x0,y0), (x1,y1)…

(xi,yi), then the values of

b1 and

b0 minimizing the sum of the

squares of the residuals is:

In the above expression the x and y with the bars on top

are the averages of x and y respectively and b1

is the slope of the regression line.

To estimate FOREX rate trends, the y’s should be the rates

and the x’s the timestamps; the slope b1

will indicate the strength of the trend. Still, for the linear regression method

to accurately deliver the strength of a trend, the data must be plentiful and

carefully selected to lie within the saga of the event that caused the trend.

Say an investor receives a piece of news that he/she considers will

generate a trend, first thing to do is verify if the market was indeed sensitive

to the reported event and how sensitive it was. If the event is such that it has

an hourly impact and it happened several hours ago, the linear regression method

applied to the data within these hours will correctly render the strength of

that trend. Had the data for the past day or past week been used, the regression

slope will have nothing to do with the trend being inquired. Also if only the

data of last ten minutes is used, it may not be enough to average out the random

component thus rendering unreliable slope values.

The MHT or Minimum Holding Time

The regression slope relates to the trend strength, since

it is the slope of the line that minimizes the residuals; the line that best

fits the data, but is says nothing about how big these residuals were. The

chances of making a profit on identifying a trend are greatly dependent on the

present market randomness.

Say

an investor found that the market was sensitive to an event that he/she knew it

happened, but there’s a lot going on besides the effect of that event and the

market is choppy. If this investor opens

a position, he/she must hold that position until the trend has had a chance of

revealing. The nature of the random motion is such that the standard deviation,

or any other interval of confidence, grows with the square root of time, while

the trend makes the rate drift proportional to the time elapsed. This means

that, if the trend holds, and I must be capitalized and underlined: IF THE

TREND HOLDS! Then there’s a time after which it becomes very likely to earn

a profit. This time is the Minimum Holding Time or MHT. Of course there’s a

chance that this investor wins, even if he/she doesn’t wait

Say

an investor found that the market was sensitive to an event that he/she knew it

happened, but there’s a lot going on besides the effect of that event and the

market is choppy. If this investor opens

a position, he/she must hold that position until the trend has had a chance of

revealing. The nature of the random motion is such that the standard deviation,

or any other interval of confidence, grows with the square root of time, while

the trend makes the rate drift proportional to the time elapsed. This means

that, if the trend holds, and I must be capitalized and underlined: IF THE

TREND HOLDS! Then there’s a time after which it becomes very likely to earn

a profit. This time is the Minimum Holding Time or MHT. Of course there’s a

chance that this investor wins, even if he/she doesn’t wait

the MHT, actually in the particular example depicted in

figure 2, the trend is strong and winning chances are always greater. Now, the

two parabolas in green, labeled as low and high limits, plot an interval of

confidence of twice the standard deviation, which equals 95% certainty. In other

words, the interval of confidence is the interval in which you can be 95%

certain to find the rate. The minimum holding time is exactly the moment after

which the chances of winning are above that 95%.

The Walker on the Train Analogy

Abstractions are easier when associating them to graphic

images. Rates and trends are abstractions that can surely make use of one like

the following:

Consider rates to be the position of a random walker on a

track. This random walker, let's call him Johnny, is on a train carrying a

light. Let there be an investor, let's call him Joe, observing this from the

top, on board of, say a balloon or even a static satellite. It is night and the

train is dark, Joe can only see Johnny's light moving back and forth. When Joe

sees the light moving, he cannot tell if it is the train, Johnny or if they both

are moving. At some point Joe gets information from some ground source that the

train might be moving in some direction, say north; Joe starts doing linear

regressions of the positions of Johnny's light in order to figure out the speed

of the invisible train. Joe decides to open a position when Johnny is at

X. At first, Joe may see Johnny going south of X and then back north, but as

time passes, Johnny walks south of X less and less frequent, until this happens

no more. Joe keeps his position open

and watches as his profit grows, but Joe must be careful, for the train could

reverse is motion if new forces develop. So, he must have an estimate of how

long the train will hold its speed in order to maximize his profits.

It is at this point that math can no longer help Joe. How

long will Joe hold his position opened? That will depend on his gut feelings, a

crystal ball or on how much he believes in market inertia. Though the train

analogy was only intended to visualize a mechanism, it may be implicitly suggesting

the existence of market inertia, simply because trains have lots of it. This

market inertia concept has its followers, but since there has been no

statistical proof of its existence, it remains a matter of faith.

One Last Thought About Trends

Trends can be analyzed from a different point of view, one

that doesn’t suggest inertia. Going back to the example of the hypothetical tax

bill that caused a down trend to USD/JPY, what the tax actually did was lowering

the USD buying power and that will finally settle the rate at a new equilibrium

average value. This transition between the initial and final rates created a

trend lasting a limited time interval. The

strength of that trend not only depended on the difference between the initial

and the final rates, but also on the time it took to settle. Highly publicized

news spread fast and so, they can generate strong trends for short period of

times even with small final rate increments. In these cases, media induced panic

is common to cause even some overshooting. Economic events with lower media

impact may produce milder trends even when having greater final increments or

decrements.

A strong trend does not mean that it will last longer than

a mild one; actually it is more likely to be the contrary. An event like the new

tax example will not produce all its effects at once, instead, it will start

triggering a series of child events that may keep the trend going for months.

From this point of view, nothing like market inertia is

suggested; a trend has no conservation tendency, on the contrary, the longer it

remains; the more likely it is that it stops.

Brownian

motion (named in honor of the botanist

Robert Brown) originally referred to the random motion observed under

microscope of pollen immersed in water. This was puzzling because pollen

particles suspended in perfectly still water had no apparent reason to move all.

Einstein pointed out that this motion was caused by the random bombardment of (heat

excited) water molecules on the pollen. It was just the result of the molecular

nature of matter.

Brownian

motion (named in honor of the botanist

Robert Brown) originally referred to the random motion observed under

microscope of pollen immersed in water. This was puzzling because pollen

particles suspended in perfectly still water had no apparent reason to move all.

Einstein pointed out that this motion was caused by the random bombardment of (heat

excited) water molecules on the pollen. It was just the result of the molecular

nature of matter. Say

an investor found that the market was sensitive to an event that he/she knew it

happened, but there’s a lot going on besides the effect of that event and the

market is choppy.

Say

an investor found that the market was sensitive to an event that he/she knew it

happened, but there’s a lot going on besides the effect of that event and the

market is choppy.